Company’s First ABS Deal Wholly Backed by RV and Marine Collateral Receives AAA-rating

NEW YORK, December 20, 2024 — Octane® (Octane Lending, Inc.®), the fintech revolutionizing the buying experience for major recreational purchases, announced that it has closed a $125.76 million securitization (“OCTL 2024-RVM1“). The notes will be collateralized by a pool of retail installment loans issued through Octane’s in-house lender, Roadrunner Financial®, Inc. that are secured by new and used recreational vehicles (RVs), powerboats, and pontoon hybrids.

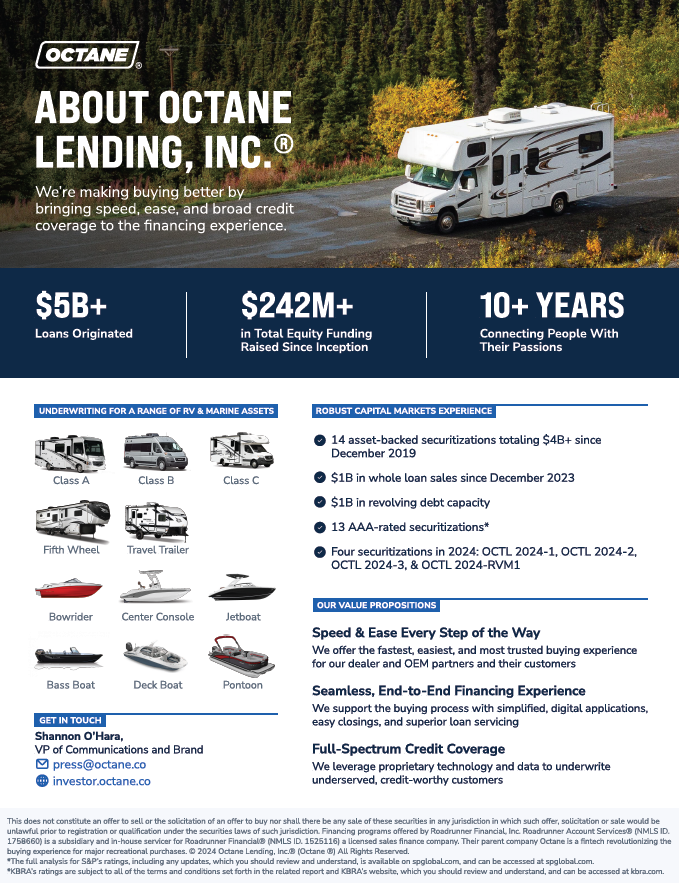

This is Octane’s first transaction under its new RV/Marine shelf, denoted with the “RVM” ticker. Octane has completed 14 asset-backed securitizations since launching its program in December 2019, including OCTL 2024-1, OCTL 2024-2, and OCTL 2024-3 in 2024. In the company’s last six powersports ABS transactions, RV and marine loans comprised approximately 1.35% or less of the pool.

OCTL 2024-RVM1 consists of five classes of fixed-rate notes: Class A, Class B, Class C, Class D, and Class E, which Standard & Poor’s (S&P)* rated as AAA, AA, A, BBB, and BB respectively, in a private offering pursuant to Rule 144A under the Securities Act of 1933, as amended. ATLAS SP Securities acted as lead manager and structuring agent, with Truist Securities serving as joint bookrunner, and J.P. Morgan Securities and Mizuho serving as co-managers.

“We are excited to build on our successful ABS track record by issuing our first securitization wholly backed by RV- and marine-collateral, which was extremely well received by the market,” said Steven Fernald, President and Chief Financial Officer at Octane. “Thanks to the strong interest from a large number of new investors as well as our existing, long-term investor partners, we are well positioned to continue to meaningfully grow our business in 2025 and beyond.”

Octane entered the RV market in 2022, doubled originations in 2023, and is on track once again to double its RV originations year-over-year in 2024. Octane first began financing pontoons in 2022 and entered the broader marine market this fall.

Octane continues to maintain a diverse capital markets strategy. In addition to completing more than $4 billion of asset-backed securitizations to date, the company surpassed $5B in aggregate originations in September 2024 and has announced or completed over $1 billion of whole loan sales since December 2023, including with large asset managers, alternative asset managers, and credit unions, while maintaining approximately $1 billion in revolving debt capacity. Earlier this year, Octane completed its Series E funding round, bringing its total equity funding raised since inception to $242 million.

This press release does not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

*The full analysis for S&P’s ratings, including any updates, which you should review and understand, is available on spglobal.com and can be accessed here.

###

This is not an offer, solicitation of an offer, recommendation or advice to buy or sell any security, financial product or instrument. Our website is for informational purposes only. We do not guarantee the accuracy or completeness of information on or available through this website, and we are not responsible for inaccuracies or omissions in that information or for actions taken in reliance on that information. Please read any applicable disclosures before using or relying on information on or available through this website. Seek professional advice before investing in our securities.