New Team to Drive Powersports and OPE Growth, and RV and Marine Market Entrances

Octane™ (Octane Lending Inc.®), the fintech revolutionizing the buying experience for major recreational and equipment purchases, today announced several key leadership appointments to support its rapid growth in Powersports and Outdoor Power Equipment (OPE), and drive its expansion into the RV and marine markets.

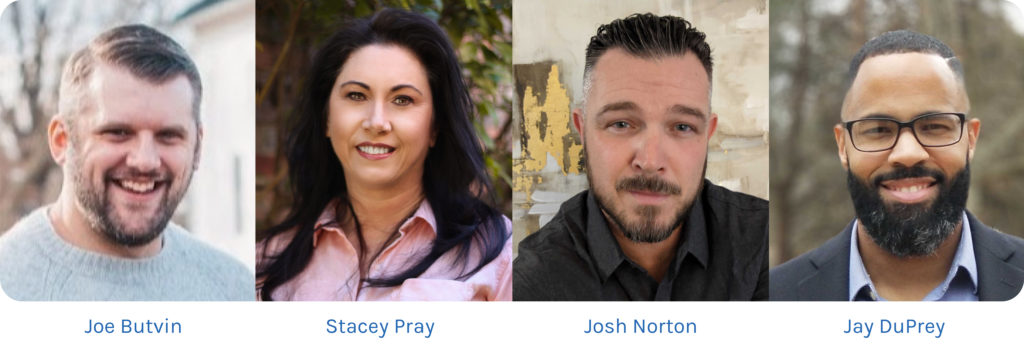

Octane has achieved considerable success in Powersports, almost doubling loan fundings in 2021, and continues to gain market share with its fast and easy digital buying experience. Octane is also investing in consumer products that support its dealer and OEM partners, such as Octane Prequal, an ecommerce tool that instantly prequalifies consumers without impacting their credit and drives incremental business in dealerships. Last year, the company grew fundings that originated in this channel by over 400%. To build on this momentum, the company appointed Stacey Pray as Director of Consumer Business Development. Ms. Pray has significant experience in customer and loan origination platforms, and customer experience optimization. She held senior positions at Ally and AppOne before becoming Octane’s Director of Consumer Operations in February 2021. In her new role, Ms. Pray will lead dealer development for Octane’s consumer products, build the company’s consumer go-to-market strategy alongside dealer and OEM partners, and strengthen the ongoing implementation of Octane Prequal.

To support Octane’s recent entrance into the trailer market and forthcoming entrance into the tractor market, Octane appointed Justin “Jay” DuPrey as National Sales Manager OPE. Bringing over 20 years of Powersports Sales, Finance, and Business Development experience, Mr. DuPrey is a proven leader who has successfully built and nurtured relationships with over 350 diverse, multi-line Powersports dealerships across the South and Mid-Atlantic, and developed and executed go-to-market strategies for new verticals. Before joining Octane in 2017 as National Sales Manager Powersports, Mr. DuPrey held roles at Coleman Powersports, ADS Inc. / MAR-VEL Int., and the US Navy. In his new role, Mr. DuPrey will lead business development and regional sales teams; drive market share in trailer, tractor, and zero-turn mower verticals; and leverage dealer feedback to strengthen Octane’s OPE programs and products.

In preparation for the company’s entrance into the RV and marine markets later this year, Octane made two key leadership appointments: Joe Butvin as Vice President, New Verticals, and Josh Norton as National Sales Manager, New Verticals.

Mr. Butvin has a record of building successful, cross-functional teams. He invented two patented financial services products during his tenure at Alliance Data Card Services and joined Octane from Klarna, where he was Head of Enterprise Sales. In his new role, Mr. Butvin is responsible for taking Octane into new verticals, beginning with RV and marine. He will work cross-functionally to establish entry strategies, then build teams to deliver successful launches.

A decisive, results-driven manager with 20 years of experience, Mr. Norton is skilled at cultivating new business, having successfully grown Octane’s market share on the West Coast of the United States as Regional Sales Manager, Powersports. He previously held sales leadership roles at Chase, Yamaha Motor Finance, and Exeter Finance. In his new role, Mr. Norton is responsible for developing and implementing sales strategies for the RV and marine markets, leading a nationwide sales team, and building long-term client relationships.

“With the appointments of Stacey, Jay, Joe, and Josh, we have the right team in place to build on our remarkable success in Powersports and OPE, and bring our faster, simpler digital buying experience to the RV and marine markets,” said Mark Davidson, Chief Revenue Officer. “I’m thrilled we were able to both attract and promote such strong leaders. Their knowledge, expertise, and creativity will help us continue to rapidly grow our business while driving incremental, qualified buyers for our dealer and OEM partners, and fueling our customers’ lifestyles.”

The four leaders will oversee teams of experienced, service-oriented professionals tasked with bringing Octane’s fast and easy digital buying experience to more consumers, dealers, and OEM partners. These remote positions showcase Octane’s ability to attract talent beyond the company’s regional hubs in New York, NY; Irving, TX; and Irvine, CA.