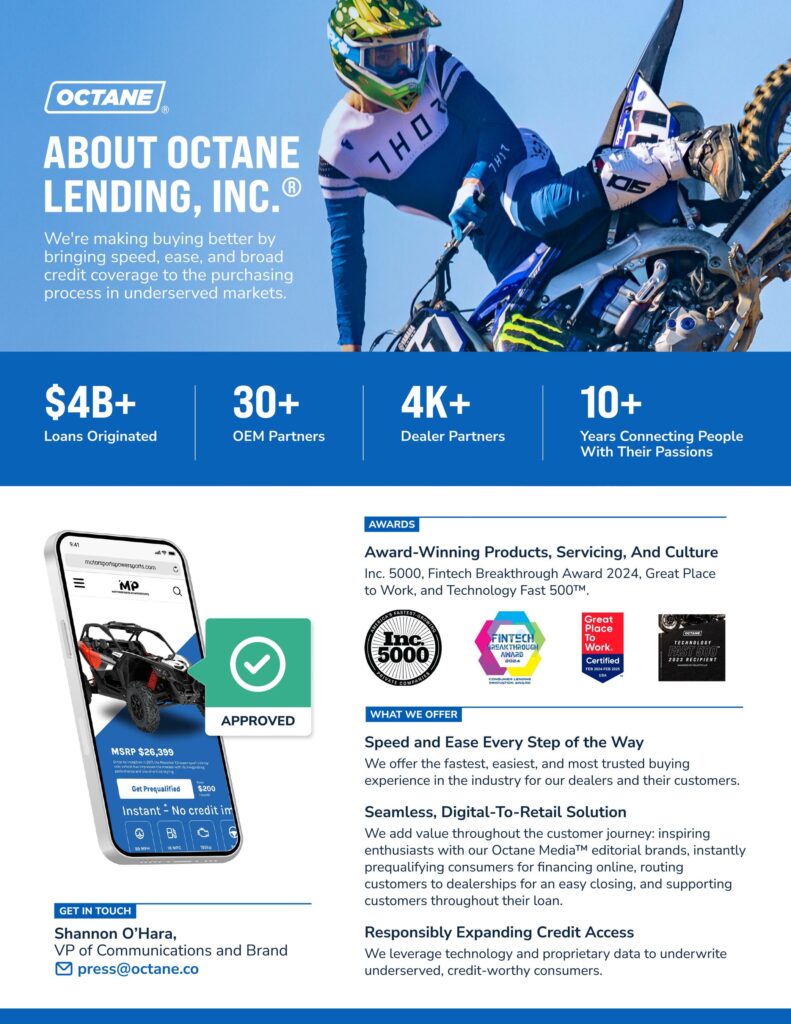

More than $4 Billion of Asset-Backed Securities Issued to Date

NEW YORK, November 14, 2024 — Octane® (Octane Lending, Inc.®), the fintech revolutionizing the buying experience for major recreational purchases, announced that it has closed a $326 million securitization (“OCTL 2024-3“) collateralized by fixed-rate installment powersports loans issued through its in-house lender, Roadrunner Financial®, Inc. Octane has issued more than $4 billion of asset-backed securities (ABS) since launching the program in December 2019. This is the company’s 12th ABS transaction.

OCTL 2024-3 consists of six classes of fixed-rate notes: Class A-1, Class A-2, Class B, Class C, Class D, and Class E, which Standard & Poor’s (S&P)* and Kroll Bond Rating Agency (KBRA)** rated as A-1+/K1+, AAA/AAA, AA/AA+, A/A+, BBB/BBB+, and BB/BB+ respectively, in a private offering pursuant to Rule 144A under the Securities Act of 1933, as amended.

J.P. Morgan Securities acted as lead manager and structuring agent, with Atlas SP Securities, Mizuho, and Truist Securities serving as joint bookrunners. In this latest ABS transaction, Octane continued to diversify its investor base while also maintaining the support of existing institutional investors.

“Thanks to the support of our esteemed institutional investors, Octane reached a significant milestone with this transaction – issuing over $4 billion of asset-backed securities in less than five years,” said Steven Fernald, President and Chief Financial Officer at Octane. “We were pleased to see such high demand for our paper among both new and existing partners, which allowed our syndicate of banks to reduce credit spreads materially from their initial guidance through final pricing to our lowest levels since 2021. Our robust capital markets execution gives us even greater flexibility as we continue to grow our business while maintaining strong credit performance.”

In addition to completing two other asset-backed securitizations, OCTL 2024-1 and OCTL 2024-2, Octane has diversified its capital markets strategy in 2024. Notable transactions include a $500 million forward-flow deal with funds managed by AB CarVal, two separate whole loan sales totaling $280 million to Yieldstreet, an evergreen forward flow transaction with a credit union, and a $200 million whole loan sale to funds managed by AB CarVal.

The ABS transaction announced today follows several significant milestones for the company. Octane recently entered the marine market, launched RideNowFinance, a private label partnership with the largest powersports retailer in North America, and surpassed $5B in aggregate originations. Earlier this year, Octane completed its Series E funding round.

This press release does not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

*The full analysis for S&P’s ratings, including any updates, which you should review and understand, is available on spglobal.com and can be accessed here.

**KBRA’s ratings are subject to all of the terms and conditions set forth in the related report and KBRA’s website, which you should review and understand, and can be accessed here.

###

This is not an offer, solicitation of an offer, recommendation or advice to buy or sell any security, financial product or instrument. Our website is for informational purposes only. We do not guarantee the accuracy or completeness of information on or available through this website, and we are not responsible for inaccuracies or omissions in that information or for actions taken in reliance on that information. Please read any applicable disclosures before using or relying on information on or available through this website. Seek professional advice before investing in our securities.